You need to make use of the property more fifty% to own company so you can claim people point 179 deduction. For those who used the assets more than 50% to own team, multiply the price of the property by percentage of business have fun with. As a result, the expense of the property that will meet the requirements on the area 179 deduction.

$5 deposit casinos

For individuals who make on the Internal revenue service regarding your income tax membership, definitely are your own SSN (as well as the term and SSN of one’s partner, if you registered a joint return) on the communication. Since your SSN can be used to identify your account, this will help to the new Irs respond to their communication punctually. Comprehend the Form W-7 instructions for how and you can where you should file..

Foreign Boss

Whether it election is established, the kid does not have any in order to document an income. Find Recommendations to own Setting 8814, Parents’ Election So you can Declaration Boy’s Interest and Dividends. The fresh Irs have authored a list of ranks which might be known while the frivolous. The new punishment to have filing a good frivolous income tax get back try $5,100000. Along with, the new $5,100 punishment usually connect with almost every other specified frivolous submissions. Instead of getting a paper view, you might be able to get reimburse transferred into your account during the a financial or other standard bank.

Radius Financial Rewards Examining Remark

We’ve said how we thought while playing with this incentives, however, we all know that every player’s feel may differ extremely. That’s why we now have complete some research to see what anybody else believe, considering one another pro views plus the check my reference opinions of other industry experts. Brango Local casino the most legitimate RTG gambling enterprises you to definitely we’ve went to. They tons quickly, is useful on the all of the gadgets, and you can guarantees immediate earnings once KYC verifications is done. The brand new Brango Gambling enterprise $one hundred free processor could have been substituted for a great $125 totally free chip.

To own purposes of the new area 179 deduction, the cost of the auto doesn’t were people number thought because of the reference to all other assets stored by you when. If so, your prices boasts precisely the dollars you repaid. The original-season restrict to your decline deduction, unique depreciation allowance, and part 179 deduction for car acquired ahead of Sep twenty eight, 2017, and listed in provider while in the 2024, is actually $several,400. The initial-season limit to the depreciation, special depreciation allowance, and you may section 179 deduction to have automobile gotten after Sep 27, 2017, and placed in service throughout the 2024 expands to help you $20,eight hundred. For individuals who choose to not claim a different depreciation allotment to own an automobile placed in provider inside the 2024, the amount grows to help you $12,eight hundred.

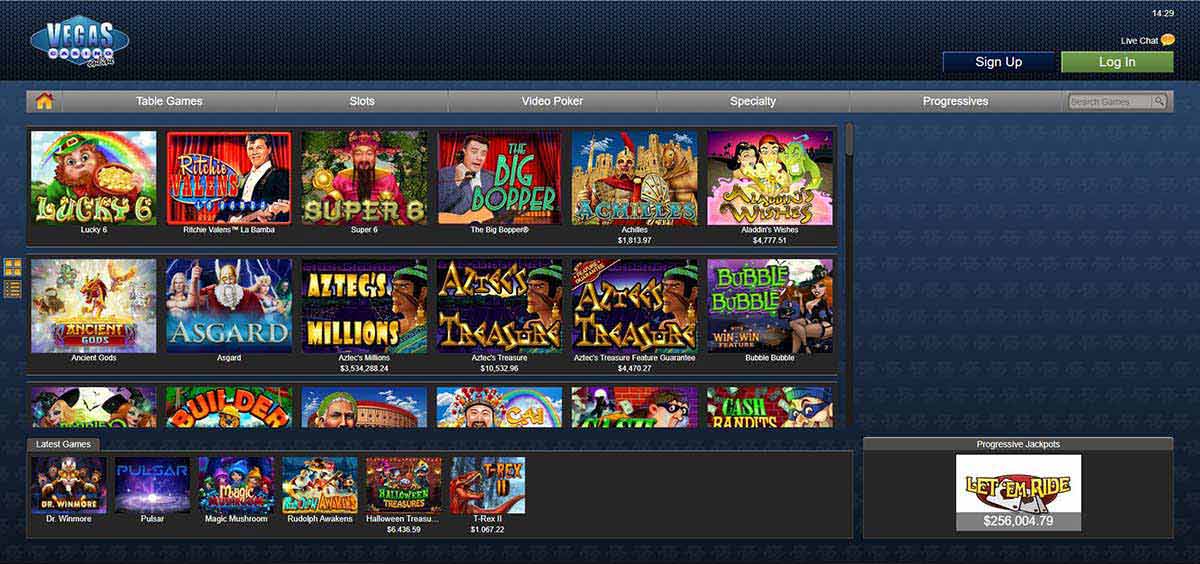

In the event the punctual earnings, crypto service, and you can an interesting playing atmosphere count most to you personally, BitStarz try a solid options. To start with launched within the 1998, Real time Gaming (RTG) are a master in the market. As among the biggest application organization, RTG offers online game to around twenty-five gambling enterprises! RTG is the best noted for its ‘Real Show’, which happen to be a variety of position game celebrated for their image, provides and you can generous earnings.

For many who operate in the brand new transport globe, but not, come across Special speed for transportation professionals, later on. The word “incidental expenses” function fees and you can information provided to porters, luggage carriers, hotel group, and you can group for the ships. You can profile the food expenditures having fun with either of the pursuing the actions. The facts are identical like in Analogy 1, other than your realistically asked the job inside Fresno in order to history 9 days.

If you use this technique, you usually statement the attention money around in which you probably or constructively discovered it. However, there are unique laws and regulations to own revealing the new discount on the particular debt tools. See U.S. Deals Securities and you will Brand-new Topic Discount (OID), earlier. Treasury cards are apt to have maturity episodes of greater than 12 months, varying to 10 years. Maturity periods to possess Treasury securities are often longer than 10 years.

If you believe you owe the brand new punishment however you do not want to figure it your self once you file the taxation come back, you will possibly not need. Fundamentally, the fresh Irs often profile the brand new punishment for you and you may give you a bill. Yet not, if you feel you can use down otherwise lose your own punishment, you should done Form 2210 or Setting 2210-F and you may mount it to the report get back. For those who don’t spend sufficient taxation, sometimes because of withholding otherwise by making quick projected income tax payments, you will see an enthusiastic underpayment away from estimated income tax and you may have to pay a punishment. Take borrowing from the bank for all your estimated taxation costs to have 2024 on the Mode 1040 or 1040-SR, range twenty-six. Were people overpayment out of 2023 you had credited to your 2024 projected income tax.

You are an unmarried pupil doing work part time and you may gained $step 3,five hundred inside the 2024. Your IRA efforts to have 2024 are simply for $step 3,five-hundred, the level of their compensation. Simplified Employee Pensions (SEPs) and Discounts Bonus Match Plans for Staff (SIMPLE) plans commonly discussed within this chapter. More resources for these preparations and you may employees’ Sep IRAs and Effortless IRAs which can be element of such arrangements, come across Pub. A revealing savings is one where assets is shared between somebody for a fee, constantly through the internet. Such, your book your car after you don’t need it, or you share the wi-fi account for a charge.

Minimal Assets

Having parlay insurance policies, you can struck all the ft except for one to and still winnings the new choice. And if your miss you to definitely toes, an internet sportsbook usually both prize the fresh winnings because the cash or a plus bet. In initial deposit match extra suits your first put by a specific amount. Put matches incentives had previously been commonly readily available since the greeting bonuses, but they are much harder to locate lately.